New York

Insider Top 100 Innovators

The Biggest IPOs to Watch in 2025: Tech Giants, Unicorns, and Market Movers

By : Syed Owais Date:September 3, 2024

Related Stories

Insider Top 100 Innovators

AI Boom Keeps Venture Funding in France Steady Amid Global Slowdown

Insider Top 100 Innovators

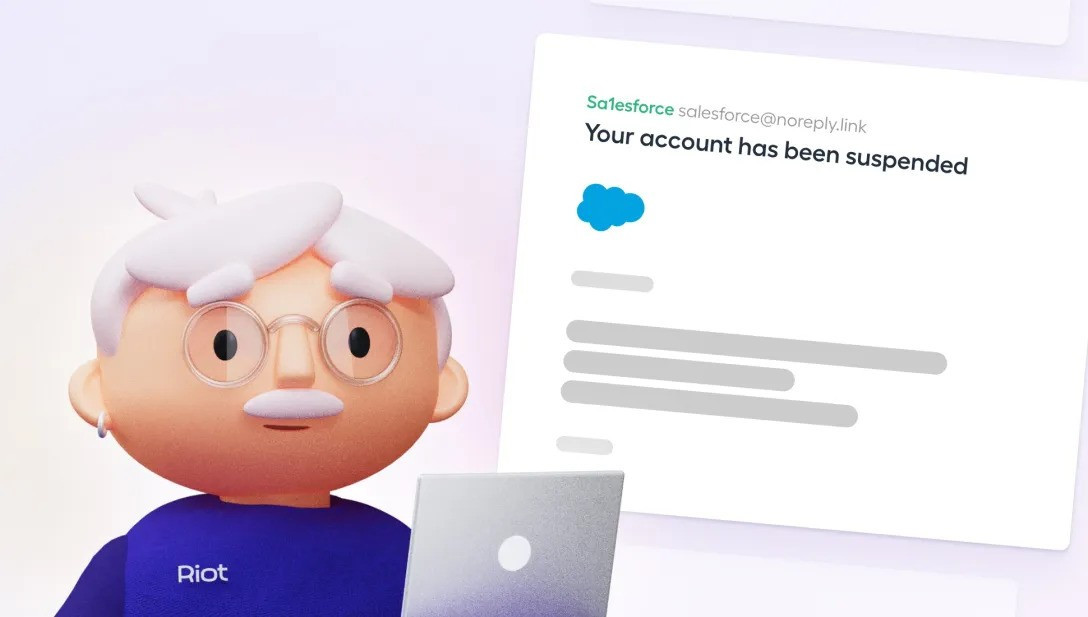

Riot Raises $30M to Revolutionize Employee-Focused Cybersecurity

Insider Top 100 Innovators

OpenAI Unveils Advanced ChatGPT Agent for Deep Research

Insider Top 100 Innovators

Google X Spins Out Heritable: AI-Powered Agriculture Startup Revolutionizing Crop Yields

Insider Top 100 Innovators

The Biggest IPOs to Watch in 2025: Tech Giants, Unicorns, and Market Movers

Insider Top 100 Innovators

The Race to Become the "TikTok for Bluesky": Emerging Apps Compete for Social Media Supremacy

Insider Top 100 Innovators

AI Agents and the Rise of the One-Person Unicorn: Innovation or Societal Disruption?

Insider Top 100 Innovators

Powerset Empowers Founders with $1M Each to Invest in the Next Wave of Startups

The IPO Boom of 2025: Who’s Going Public and What It Means for the Market

After a volatile few years in the public markets, 2025 is shaping up to be a pivotal year for IPOs. With tech giants, AI-driven startups, and long-awaited unicorns gearing up to go public, investors are keeping a close eye on the next wave of market debuts.

From fintech disruptors to AI pioneers, these IPOs could set the tone for the next phase of economic growth—or reveal cracks in the post-pandemic recovery.

The Heavy Hitters: Which Companies Are Eyeing an IPO?

1️⃣ AI & Tech Unicorns Take Center Stage

Artificial intelligence remains the hottest sector, and several AI-first startups are ready to capitalize on the hype. Companies specializing in generative AI, automation, and enterprise software are expected to dominate IPO filings.

🔹 DeepAI – A leader in generative AI models, DeepAI is expected to be one of the year’s biggest IPOs.

🔹 QuantumLogic – This quantum computing firm is rumored to be preparing for a multi-billion-dollar public debut.

2️⃣ Fintech & Payments Disruptors

With digital finance continuing to grow, fintech companies that have reshaped payments, lending, and banking are lining up to hit the public markets.

🔹 NeoBank+ – The challenger bank has built a loyal customer base and is now looking to expand its market influence.

🔹 PaySwift – A fast-growing payments processor, PaySwift has quietly filed for an IPO that could value it at over $10 billion.

3️⃣ Enterprise Software & Cloud Leaders

The demand for cloud computing, cybersecurity, and automation remains high, and several B2B giants are preparing for Wall Street debuts.

🔹 SecureNet – A cybersecurity firm tackling enterprise security at scale.

🔹 DataSync – A cloud-based analytics company helping businesses leverage AI-driven insights.

What This IPO Wave Means for Investors

Market Momentum – A strong IPO pipeline signals confidence in economic recovery.

Investor Opportunity – High-growth sectors like AI and fintech could attract heavy investment.

Valuation Risks – Some startups may face overinflated expectations in a competitive market.

As regulatory scrutiny, interest rates, and market conditions continue to shape IPO strategies, 2025 could be a defining year for tech and finance.

Will this year’s IPO class live up to the hype or struggle in a cautious market? One thing is certain: Wall Street is watching.

Syed Owais

Founder & Fractional CBO - Who loves to deliver value over hype. Aiming to build a no-BS community for founders (by founder), investors, venture capitalists, accelerators and journalists.

Subscribe

- Gain full access to our premium content

- Never miss a story with active notifications

- Browse free from up to 5 devices at once

Celebrities